Introduction

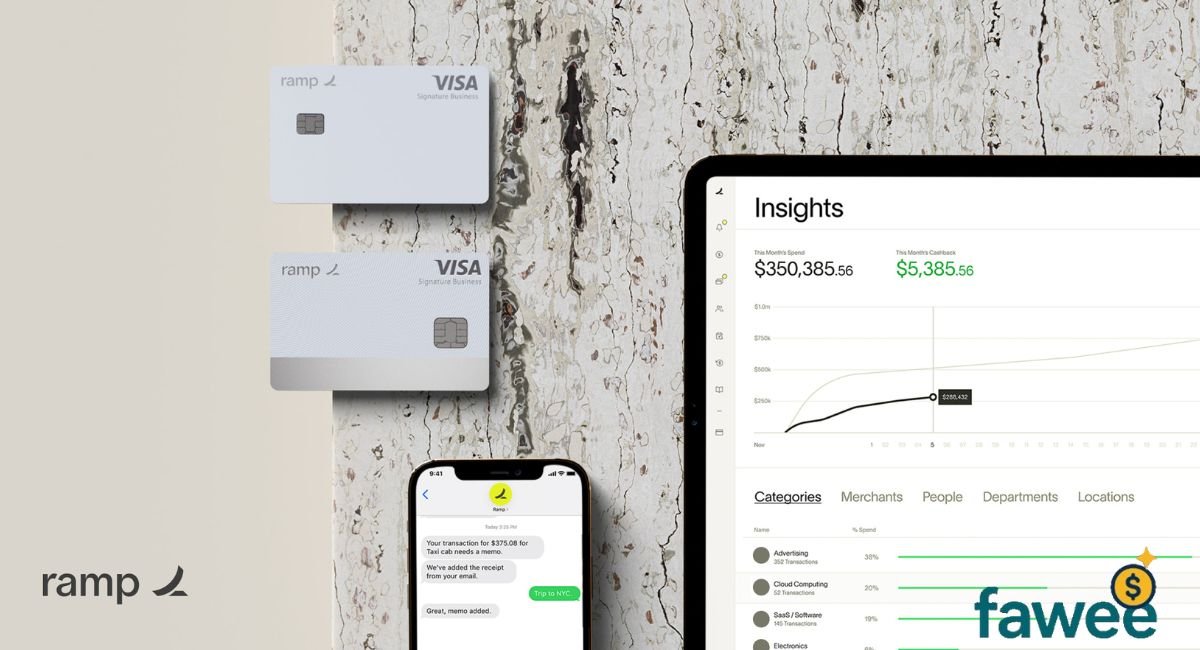

Managing company spending is no longer about paper receipts or complicated reimbursements. Today, businesses need smarter tools — and Ramp Virtual Cards deliver exactly that.

These virtual corporate cards give finance teams full visibility, faster payments, and stronger control over every transaction. With built-in AI automation, real-time expense tracking, and instant card creation, Ramp makes business spend management effortless.

Whether you’re a startup looking to simplify expenses or an established firm aiming to boost efficiency, Ramp Virtual Cards combine digital convenience, cashback rewards, and secure online payments into one powerful solution.

Keep reading to discover how Ramp is transforming modern finance — one virtual card at a time.

—————-

What Is Ramp and How It Works

So, Ramp’s kinda like this modern tool for businesses that wanna keep their spending under control without all the mess. It’s a corporate expense management platform — but way simpler and smarter than the old-school ones. You can track expenses, manage budgets, and yeah, instantly create these cool Ramp Virtual Cards for your team.

How Ramp Virtual Cards Work

Basically, these virtual cards are digital versions of company cards. You can create one in seconds, assign it to someone, and boom — they’re good to go. Each card has its own limits and approval rules, so you’re not stressing about overspending. Everything shows up in real time too, which means no more waiting or guessing where the money went.

Why Businesses Choose Ramp

A lot of companies are switching to Ramp because it does most of the boring finance stuff automatically. It tracks, analyzes, and gives insights — all in one place. No more hopping between five different apps just to see who spent what. You can manage vendor payments, reimbursements, and team expenses right inside the same dashboard. It’s all connected, which is super handy.

Instant Issuance and Control

One of the best things? You can create as many cards as you need. Like, if someone’s working on a project, you can make a new card for them right away. Set the rules, spending limits, and you still have full control. Honestly, it’s a lifesaver for finance teams that wanna move fast but stay organized.

Integration with Accounting Tools

Ramp also plays nice with QuickBooks, Xero, and NetSuite — all those big accounting tools. Every expense syncs automatically, so you don’t have to spend hours reconciling stuff at the end of the month. If you like clean books and real-time visibility (and who doesn’t?), it’s a solid choice.

—————-

Key Features of Ramp Virtual Cards

Unlimited Virtual Card Creation

Ramp makes expense management super simple. You can create as many virtual cards as you want — for employees, teams, or even a single vendor. Each card can have its own spending limit, category, and expiry date, so you’re always in full control of every dollar.

Need a card for travel, software, or maybe a quick marketing campaign? You can make one instantly. No waiting for approvals or paperwork. And if something changes — like a project ends — you can just disable or edit the card in seconds. It’s really handy, especially for startups or companies with lots of remote teams.

Real-Time Expense Tracking

Every time someone uses a Ramp Virtual Card, the transaction shows up right away on your dashboard. You can literally see company spending as it happens. That means no “end-of-month surprises.”

Ramp automatically syncs the data, sorts expenses by category, and shows where the money’s going — all within seconds. No messy spreadsheets or manual updates. Just clean, real-time visibility that helps you keep budgets in check.

Smart Spending Controls

This is one of Ramp’s best features. You can set your own policies, budgets, and approval steps for each team or employee. Basically, it gives you full control over who spends what — and how.

If someone overspends or does something outside company policy, you can pause or cancel their card instantly. You’ll even get alerts for anything unusual. It’s a great way to prevent misuse while keeping everyone accountable. Plus, it saves managers a ton of stress.

Receipt and Invoice Automation

Let’s be honest — manual expense reports are a pain. Ramp fixes that with its smart receipt automation. Whenever someone makes a purchase, the system automatically grabs the receipt, matches it to the transaction, and stores it safely in your records.

No more chasing employees for receipts or uploading pictures. Ramp’s AI does the boring stuff — tagging, categorizing, filing — so finance teams can actually focus on, you know, real financial work.

Advanced Security Features

Security’s a big deal for Ramp. Every virtual card comes with built-in encryption, fraud detection, and instant locking options. If something suspicious pops up, you can freeze or delete the card in seconds.

You can even create single-use cards for one-time payments or restrict them to specific merchants. Ramp’s AI constantly monitors transactions to catch anything odd. It’s safe, smart, and perfect for online spending.

Integration with Accounting Systems

Ramp works nicely with tools like QuickBooks, Xero, and NetSuite. All your transactions sync automatically, so there’s no manual data entry or reconciliation mess.

Everything — from vendor payments to expense reports — stays aligned and updated in real time. It’s basically plug-and-play for your finance workflow. Whether you’re running a small team or a full enterprise setup, it just saves you hours of cleanup work.

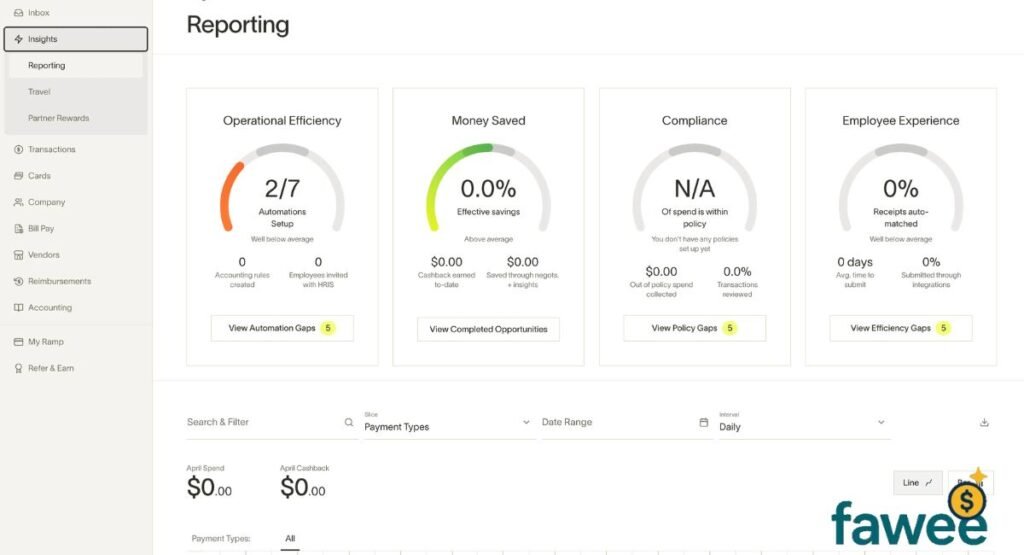

AI-Powered Insights

This part’s pretty cool. Ramp doesn’t just track spending — it actually analyzes it. The AI looks for trends, unused subscriptions, or vendors you might be overpaying. Then it gives you tips to save money.

You can track performance as it happens and adjust budgets early. It’s like having a nonstop financial advisor turning your spending data into useful insights.

—————-

Benefits for Businesses and Teams

Simplified Expense Management

Ramp makes expense management stress-free. Every payment and transaction lives in one place, automatically sorted and categorized for you. No more messy spreadsheets — just clean, organized data that saves hours of work.

Custom Controls for Every Employee

You can give each team member their own virtual card with specific limits and rules. It’s flexible — you set the boundaries, and they spend within them. No awkward approval waits, no overspending drama. Employees feel trusted to handle what they need, and you still keep full control. Win-win.

Instant Card Issuance and Use

No waiting for plastic cards to show up in the mail. Ramp Virtual Cards are created instantly — ready to use online or even in mobile wallets. Perfect for teams that move fast or work on tight deadlines. Someone needs to buy software or book a flight? Done in seconds.

Enhanced Budget Visibility

With Ramp, finance leaders can finally see exactly where the money’s going. The dashboard shows live spending across teams, so you can catch issues early and make decisions that actually make sense.

Reduced Fraud and Misuse Risks

Each Ramp Virtual Card is unique, which makes it super easy to trace any weird or unauthorized spend. You can block vendors, limit usage, or freeze cards anytime. With AI keeping an eye on things, the risk of fraud or misuse drops big time.

Seamless Reimbursements and Accounting

The whole reimbursement thing? Basically gone. Ramp’s AI tracks expenses automatically, matches receipts, and updates your accounting system. Employees don’t have to fill out long reports, and finance teams get accurate data — instantly. Less paperwork, fewer headaches.

Reward-Driven Efficiency

And here’s the bonus — Ramp gives cashback and partner rewards on your everyday spending. So, every software purchase, every subscription, every ad payment earns something back. It’s like turning normal expenses into savings. Pretty smart, honestly.

—————-

Rewards and Redemption Options

Flat-Rate Cashback on Every Purchase

Every transaction made with Ramp Virtual Cards earns a simple, flat 1.5% cashback—no categories to track or limits to remember. This consistent structure keeps reward earning transparent and effortless for all business expenses.

Exclusive Partner Discounts

With Ramp, you can tap into more than $350,000 worth of partner rewards — from AWS to QuickBooks and Gusto. Using Ramp Virtual Cards unlocks real perks that help your business grow and run smoother every day.

Automatic Reward Tracking

Ramp keeps things simple — your cashback and partner rewards are tracked automatically in the dashboard. As your team spends, the AI updates your rewards in real time, so you always know exactly what you’ve earned.

Flexible Redemption Options

You can redeem your Ramp rewards for statement credits, Ramp services, digital gift cards, or loyalty points — all managed easily from your dashboard.

Instant Redemption Experience

Most Ramp Virtual Card redemptions process within hours, not days. Whether you’re using rewards to offset balances or claim a business perk, Ramp ensures quick, digital fulfillment to keep finances flowing smoothly.

Team-Wide Incentives

Companies can use Ramp Virtual Cards to motivate employees by sharing benefits earned from collective spending. These built-in financial incentives help boost engagement and make team purchases more rewarding.

—————-

Pricing and Fees Overview

No Annual or Hidden Fees

One of the biggest advantages of Ramp Virtual Cards is that they come with $0 annual fee. There are no setup costs, hidden charges, or surprise markups, making Ramp a budget-friendly option for growing businesses.

Zero Interest, Full Transparency

Ramp operates as a charge card, meaning your balance must be paid in full each month. There’s no APR or interest, giving businesses clear and predictable payment terms that simplify financial planning.

Free Virtual and Physical Cards

Every account includes unlimited virtual and physical cards at no extra cost. This helps teams issue cards instantly while maintaining centralized control through the Ramp spend management platform.

Foreign Transactions Without Extra Costs

Whether your business operates locally or internationally, Ramp Virtual Cards have zero foreign transaction fees. That means you can make global payments without worrying about currency markups or conversion charges.

Optional Paid Platform Features

Ramp cards are free, but the platform also offers premium tools and automation features for businesses that want deeper insights, more integrations, and greater control.

Predictable Cost Management

Ramp’s pricing model supports financial efficiency by removing complex rate structures. With flat rewards and transparent costs, companies can easily forecast expenses and focus on growth instead of fees.

—————-

Who Can Qualify for a Ramp Virtual Card

Eligibility for Registered Businesses Only

Ramp’s not for individuals or freelancers — it’s strictly for registered U.S. businesses. That includes LLCs, C-Corps, S-Corps, and nonprofits. So, if your company’s officially registered and operating in the U.S., you’re good.

But yeah, if you’re a sole proprietor or an independent contractor, Ramp’s corporate card program won’t apply just yet.

Minimum Cash Balance Requirements

Ramp doesn’t look at your personal credit score — which is a big plus. Instead, it checks your company’s cash flow and overall liquidity.

Usually, your business needs at least $25,000 in a U.S. business bank account to qualify. That’s Ramp’s way of making sure you’ve got stable finances and can pay off the balance in full each month.

No Personal Guarantee Needed

Here’s something founders love — no personal guarantee required. That means your personal credit stays safe and separate from your business credit. The liability stays with the company, not you.

So if you’re managing funds responsibly, you get all the perks without putting your personal finances on the line.

Businesses with U.S. Presence and Operations

Your company does need a real U.S. presence — an actual physical address (not just a P.O. box or virtual office). Ramp’s built for U.S.-based businesses that mainly operate here.

That said, the cards themselves can be used globally. So you can make purchases or payments abroad with zero foreign transaction fees. Pretty convenient for international teams.

Strong, Consistent Cash Flow

Ramp’s a charge card, so the balance gets cleared every month. Because of that, it’s better suited for businesses with steady income or funded startups with predictable revenue.

Ramp uses your bank data to decide spending limits — basically checking how much money flows in and out. The more stable your cash flow, the higher your limit can go.

Ideal for Tech-Driven and Growth-Focused Companies

You’ll notice Ramp attracts a lot of fast-moving startups, SaaS companies, and modern teams that live on automation and data.

If your business values real-time tracking, AI-powered insights, and streamlined systems — Ramp just fits right in. It’s built for teams that like to move quickly but still stay organized.

Financial Transparency and Bank Verification

When you apply, Ramp securely connects to your business bank account. It checks your cash reserves and transaction activity — all automated, no lengthy paperwork or credit checks.

It’s actually a super smooth process. You get verified faster, and the approval stays transparent from start to finish.

Qualification for Nonprofits and Larger Enterprises

Ramp’s not just for startups. Nonprofits and large corporations can use it too.

Nonprofits get easy spend tracking and digital controls, while big enterprises appreciate the scalability — especially with unlimited virtual cards for departments or teams. It adapts easily to both kinds of setups.

Quick and Simple Approval Process

The approval process is usually done in one to three business days. Once you’re approved, you can start creating virtual cards instantly, assign them to employees, and track everything inside Ramp’s dashboard. It’s really that fast.

Why Financial Readiness Matters

Ramp’s all about financial discipline, not credit dependency. So if your business maintains solid cash flow, a healthy balance sheet, and transparent spending habits — you’re already in a great spot.

It’s designed for modern companies that want to manage money digitally, efficiently, and with complete control.

—————-

Security and Misuse Prevention

Advanced Fraud Protection

Ramp takes security seriously. Every transaction is tracked in real time, so if something looks even a little off, your finance team gets an instant alert. The system’s built with enterprise-grade fraud detection — it’s like having a 24/7 security guard watching your company’s spending.

Custom Spending Controls for Each User

You can set different spending limits and approval rules for every team or employee. Want marketing to have a higher cap but keep travel tight? Easy. These built-in controls make sure money’s used exactly how you intend — no surprises, no overages.

AI-Powered Transaction Monitoring

Ramp’s AI constantly learns your company’s spending habits. So when something doesn’t look normal — like a weird vendor or unexpected charge — it flags it right away. It’s smart enough to catch patterns humans might miss, which means problems get stopped before they turn serious.

Vendor-Specific and One-Time Cards

Need extra control? You can create single-use cards or ones locked to a specific vendor. That way, even if a number gets leaked, it’s useless anywhere else. Every virtual payment stays tied to an approved transaction — super handy for reducing fraud risks.

Real-Time Policy Enforcement

Ramp applies your company’s expense policies automatically, right when someone tries to make a purchase. If it’s out of policy — boom, it’s declined. No awkward conversations later, no messy reports. Just instant, clean compliance every time.

Instant Locking and Card Revocation

If someone leaves the team or a card gets compromised, you can lock or deactivate it with one click. No waiting, no hassle. It gives finance teams full control and peace of mind that funds are always secure.

End-to-End Data Encryption

Ramp uses bank-level encryption — 256-bit SSL — plus secure cloud systems to keep all financial data protected. Every detail, every transaction, every card number is encrypted end to end. It’s designed to keep hackers and unauthorized users completely out of the picture.

Audit Trails and Transparency

Everything on Ramp is logged automatically. You can see every transaction, every user action — nothing slips through. It’s a complete audit trail that makes compliance, reporting, and accountability a whole lot easier.

Employee Misuse Prevention

Ramp’s built-in spend tracking tools help stop personal spending before it happens. Since every transaction’s visible in real time, employees stay accountable and spending stays clean. It encourages responsibility without adding extra pressure.

Continuous Security Updates

Ramp never stays still. Its AI and security tools keep learning and updating to stay ahead of new fraud tricks. As scams evolve, Ramp evolves right with them — so your business stays protected.

—————-

Ramp vs Competitors (Brex, Divvy, etc.)

Ramp vs Brex: Simplicity and Transparency

When comparing Ramp Virtual Cards with Brex, the biggest difference is in simplicity. Ramp offers a flat 1.5% cash back with no category tracking, while Brex uses a points system that varies based on spend type. Ramp’s clear, no-strings rewards are easier to manage for teams focused on predictable financial control.

Cash Flow Requirements

Ramp requires at least $25,000 in a business account to qualify, whereas Brex often tailors limits based on your company’s cash flow and linked accounts. For established startups or mid-sized businesses, Ramp’s system feels more transparent and performance-driven.

Brex Features vs Ramp Tools

Brex offers high rewards on travel and rideshare spending, appealing to companies with frequent travel needs. However, Ramp Virtual Cards excel in automation and spend management, featuring built-in receipt matching, AI expense analysis, and accounting integrations — making it ideal for finance-driven teams.

Ramp vs Divvy: Automation and Budget Control

Divvy (now part of BILL) focuses heavily on budget control and flexible repayment options, allowing weekly or monthly pay schedules. Ramp, on the other hand, prioritizes automation and zero interest, ensuring every transaction is tracked and reported automatically through its spend platform.

Rewards and Repayment Structure

Divvy’s rewards vary depending on how often you pay your balance, while Ramp keeps it simple with consistent cashback. Businesses that prefer clarity over complexity often find Ramp’s structure easier to maintain long-term.

Expense Management Software

Both Divvy and Ramp integrate with major tools like QuickBooks and Xero, but Ramp’s real-time expense tracking and AI policy enforcement stand out for teams seeking fewer manual approvals and tighter control.

Ramp vs Traditional Corporate Cards

Unlike traditional business credit cards, Ramp Virtual Cards don’t require a personal guarantee or credit check, protecting your personal credit while building your company’s credit profile. Old-school bank cards often charge annual fees and interest, but Ramp eliminates both to encourage financial efficiency.

Scalability and User Control

Ramp’s unlimited card issuing, advanced approval flows, and team-based spending limits make it ideal for scaling companies. While Brex and Divvy also offer team management, Ramp’s AI-driven automation and analytics make it faster for CFOs and finance leaders to identify spending trends and savings opportunities.

Overall Comparison Verdict

For companies that value automation, transparency, and ease of use, Ramp Virtual Cards are the stronger choice. Brex might appeal to points maximizers, and Divvy suits those seeking flexible payment schedules — but Ramp’s no-fee, real-time control system makes it one of the best all-in-one spend management platforms in 2025.

—————-

Is Ramp Virtual Card Right for You?

Ideal for Growing Startups and Modern Businesses

If your company loves automation, control, and visibility — Ramp’s probably a great fit. It’s made for startups, SaaS teams, and modern businesses that wanna manage spending smarter, not harder. No complex systems or outdated corporate card headaches — just clean, simple expense control that actually works.

For Teams That Prioritize Efficiency

Ramp cuts out the boring stuff. No more chasing receipts or waiting around for approvals. Everything happens automatically — syncing, tracking, reporting — all in one dashboard. It’s perfect for busy teams that need to move fast but still stay accurate.

No Hidden Fees, Just Smarter Spending

One thing people love about Ramp? It’s 100% free to use. There are no annual fees, interest rates, or hidden charges — just powerful tools and rewards at no extra cost. That means more money stays in your business, where it belongs.

Perfect for Remote and Hybrid Work Environments

Got a remote or hybrid team? Ramp makes that easy too. Since everything’s digital, your employees can spend securely from anywhere — and you can still track every transaction in real time. It’s built for the way modern teams actually work.

For Finance Leaders Who Need Insights

Ramp isn’t just another card — it’s more like a smart finance assistant. The platform’s AI digs into your data, finds where you might be overspending, and helps optimize cash flow. CFOs and finance leads get real insights instead of endless spreadsheets.

When Ramp Might Not Be Ideal

If you’re still early in your business journey, Ramp’s $25,000 minimum balance might seem out of reach. But for funded startups or expanding small businesses, the value Ramp offers more than makes up for it — it’s a platform built for scaling with speed and confidence.

Final Verdict

Ramp Virtual Cards do more than just handle payments — they make managing business expenses easy. You can track spending in real time, set controls instantly, and issue unlimited cards. On top of that, you’ll earn 1.5% cashback, pay no annual fees, and connect effortlessly with QuickBooks or Xero. If your team wants automation, clarity, and savings, Ramp’s a total no-brainer — simple, secure, and made to grow with you.